From adverse price movement to macroeconomic forces, the investment world no doubt is full of risk. And it’s no surprise investors, traders and businesses are always on the lookout for ways to mitigate those risks says experts of AAG Markets. Forex Hedging itself is an action taking in the form of investment to offset the potential loss or reduce the risk of losses from an asset. In foreign exchange (Forex), hedging can be a useful tool to mitigate the risk that comes with transactions in foreign currencies.

Hence, AAG Markets, a global financial firm is going to discuss everything you need to know about Forex hedging, including the strategies employed in forex hedging. Read on!

What is Forex Hedging?

According to experts of AAG Markets, Forex Hedging is the act of protecting one’s financial position against risk or severe movements in the market. This is strategically carried out by placing a hedge in the opposite direction within the same currency pair or buying Forex options.

Companies or businesses involving in international trade are most times prone to risk due to fluctuations in the value of foreign currencies. Hence, the need to offset the potential loss and safeguard positions in the foreign exchange market becomes inevitable. However, when a company sets up a hedge and there occurs a favorable movement in the market, the company will also have to forgo the gains or profits.

It is important to know that not all Forex brokers allow hedging and it is illegal in some financial markets mainly the US. Therefore, ensure you check out the policy first before engaging in Forex hedging.

Strategies Involve in Forex Hedging

There are different strategies that Forex traders implement to hedge against risk. However, the AAG Markets explores 3 commonest strategies that you can implement depending on your level of experience and the brokers’ hedging policies.

1. Simple Forex Hedging

A simple Forex Hedging strategy is a way in which a trader protects his position from volatility or undesirable move by opening an opposing position in the same currency pair. That is, a trader can go long (buy a position) and then go short (sell a position) on the same currency pair. Hence, all potential risks (gain included) are eliminated at the same time. This is also known as direct hedging and it is the simplest form of Forex Hedging.

Although the gain on this strategy is zero, there are still chances of making money when you keep the original position and then make money through your short position when the market trend reverses.

2. Multiple Currency Hedging

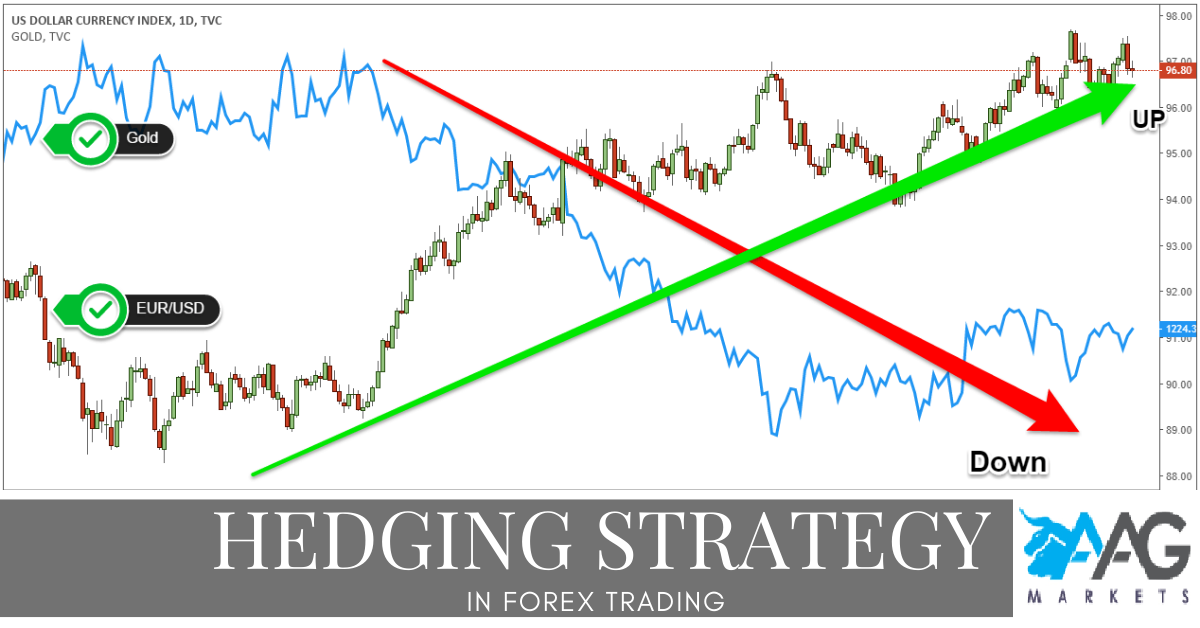

This is a multi-currency cross hedging strategies traders use in reducing exchange rate risk. It is more complex than simple Forex Hedging and companies operating in two or more countries with different currencies most often do employ this approach to protect their position.

Multiple currency hedging involves buying a long position in one currency and a short position in another currency to reduce risk. This means selecting two positively correlated currencies such as EUR/USD or KWD/USD and then taking different positions on both sides. For instance, a trader might take a long position in the EUR/USD market and then hedge the risk by buying a short position in the KWD/USD. The aim is to hedge the risk of exposure of USD. However, this does not safeguard any fluctuations that might occur in both EUR and KWD.

If this strategy works in your favor, you might make some profit, and if otherwise, you might incur losses in multiple currencies. Therefore, hedging more than one currency pair carries its own risk.

3. Forex Options Hedging

Options have been popularly used over the years as a useful tool to hedge against exposure to risks. A Forex option is an agreement to make an exchange at a specified price and at a specific time in the future.

For instance, a trader can buy a put option for a specified time after going long on a currency but expect to see currency value diminish. Whereas, a trader who has gone short on a currency pair can buy a call option to reduce the risk that might arise when the movement moves upward. However, this strategy is an imperfect hedge and can eliminate some of the risks.

Can I involve in a Forex Hedging?

As a business or trader, the main reason for hedging is to limit the risk of exposure when there is market volatility says experts of AAG Markets. Businesses making transactions in different currencies can benefit from Forex hedging and if timed right, can make profits.