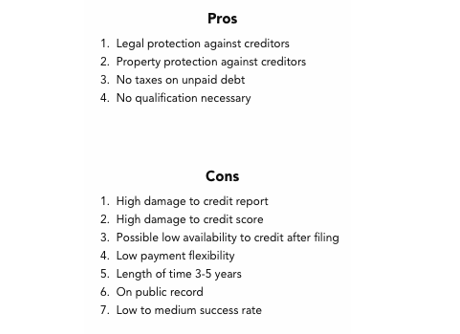

You could be at the stage where you are hoping to learn a bit more about bankruptcy before taking any further steps. Bankruptcy can be an intimidating and overwhelming process, so it is imperative that you understand the pros and cons to bankruptcy. One step can be to speak with a bankruptcy attorney for a free consultation, however, it can be also helpful to take a bankruptcy calculator to see pros and cons before doing so.

What is a Bankruptcy Calculator?

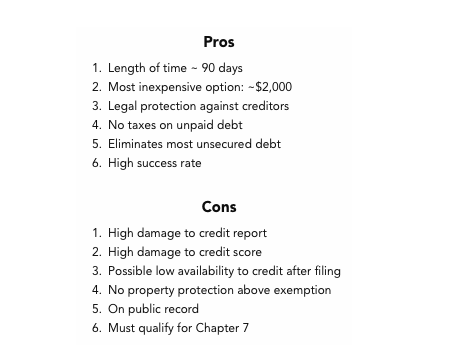

Understanding the cost, pros and cons, and credit impact of bankruptcy is crucial before filing. You can find Chapter 7 and Chapter 13 bankruptcy calculators online to learn about the costs, impact, and cons. It won’t necessarily go into the nitty gritty details such as why an appraisal is needed for a bankruptcy, but it will give you a good understanding of your options.

How Chapter 7 Bankruptcy Calculators Work

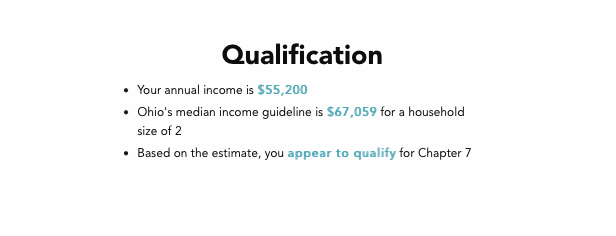

A bankruptcy calculator should provide you with the key information essential to making the decision to file bankruptcy. Chapter 7 bankruptcy, also known as, “the liquidation” bankruptcy, is the process where you wipe out all of your unsecured debts and high value assets. In order to be able to file a Chapter 7 bankruptcy, you need to be able to qualify. Qualification is based a few factors:

- Over 8 years since you filed Chapter 7 Bankruptcy last

- Annual gross income

- Household Size

- State of Residence

When taking a Chapter 7 bankruptcy calculator you should be able to receive an estimate of your qualification with an approximated attorney fee and filing cost. Please note that the qualification is based on Chapter 7 bankruptcy income limits.

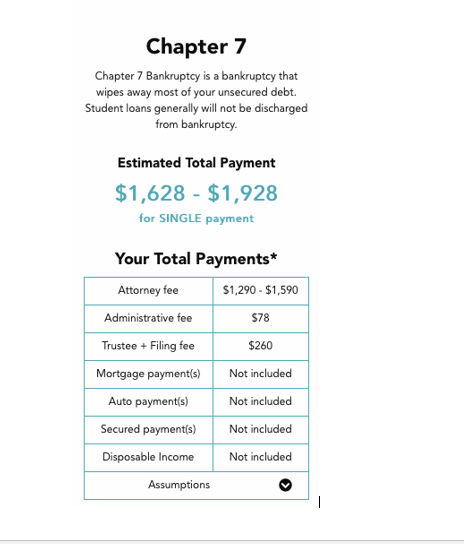

Understand the Costs of Bankruptcy

The calculator will also give you an estimate of how much it costs to file bankruptcy. However, it is important to note which state you are in. Costs for bankruptcy can range from state to state. For example, a Chapter 7 bankruptcy could be more expensive in California than it does in Alaska. That said, there are ways to make Chapter 7 bankruptcy affordable.

How Chapter 13 Bankruptcy Calculators Work

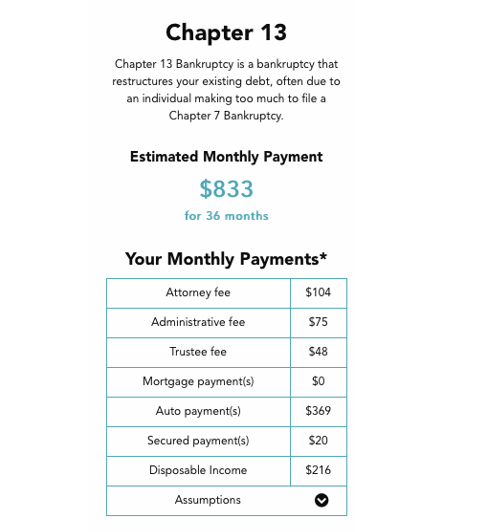

Chapter 13 bankruptcy, similar to Chapter 7, wipes out your unsecured debt. However, the process of a Chapter 13 bankruptcy is different, as you are restructuring your existing debt into a 3 – 5 year payment plan. The plan payment estimate is different for everyone, as it depends on a number of factors:

- Monthly disposable income

- Auto loans

- Secured loans

- Mortgage payments

- Attorney fee

- Administrative fee

- Trustee fee

When you take the Chapter 13 means test calculator you should be able to receive an estimate of your Chapter 13 plan payment, as well as the pros and cons attached to the process.

You should be able to see what will be included in your Chapter 13 bankruptcy, as well as the clear pros and cons attached.

How to Find a Bankruptcy Calculator

Finding the right bankruptcy calculator is key, as it is extremely important to have the most accurate information before speaking with a local attorney for a consultation. If you have already gone through a bankruptcy calculator and are ready to understand attorney fees, you can take the attorney fee calculator to estimate the costs near you.

As stated earlier in the article, you should find a bankruptcy calculator that lays out all of the fees, pros, cons, and qualifications. There are tons of small pieces included in a bankruptcy, so finding one that takes into account state exemptions can help you understand your best option. You should be able to search up “Chapter 7 Bankruptcy Calculator” or “Chapter 13 Bankruptcy Calculator” in Google to start your search process.

How to Use the Bankruptcy Calculator

Now that we have told you about what bankruptcy calculators are and how to find one, let’s dive into how to actually use the calculator. Here is a step-by-step guide of how to use a bankruptcy calculator:

1. Understand Your Total Unsecured Debt Amount

You will be asked in the bankruptcy calculator to state your total unsecured debt to help analyze the best option for you. Fortunately, this can just be an estimate, you will get more granular when you speak with the local bankruptcy attorney.

2. Breakdown Your Household Income

For understanding possible qualifications for Chapter 7 bankruptcy or payment plan for Chapter 13, you will want to have your monthly gross income handy during the calculator.

3. Take a Look at Your Secured Debts

If you have any secured debts such as auto payments, secured loans, or a mortgage, you will want to have those available or understand the monthly expense attached to each. On the note of a mortgage, if you know how much equity you have that will be helpful as well. Understanding your total equity can be extremely helpful as it will let you know if you may be able to protect your home in a Chapter 7 bankruptcy through the bankruptcy homestead exemptions.

Conclusion

You may be at the point where you are trying to understand the bankruptcy process and which Chapter is right for you. Bankruptcy can be intimidating and overwhelming, so it is imperative to understand the pros and cons of bankruptcy. You can either speak with a local attorney for a free evaluation or first take a bankruptcy calculator to understand costs.

You must be logged in to post a comment.

The Means Test determines Chapter 7 Bankruptcy eligibility and is designed only to pass those who cannot pay their debts in any capacity. Passing the means test ensures that a filer does not have disposable income to pay off debts and restricts the number of filers who can have debts forgiven through this type of bankruptcy.