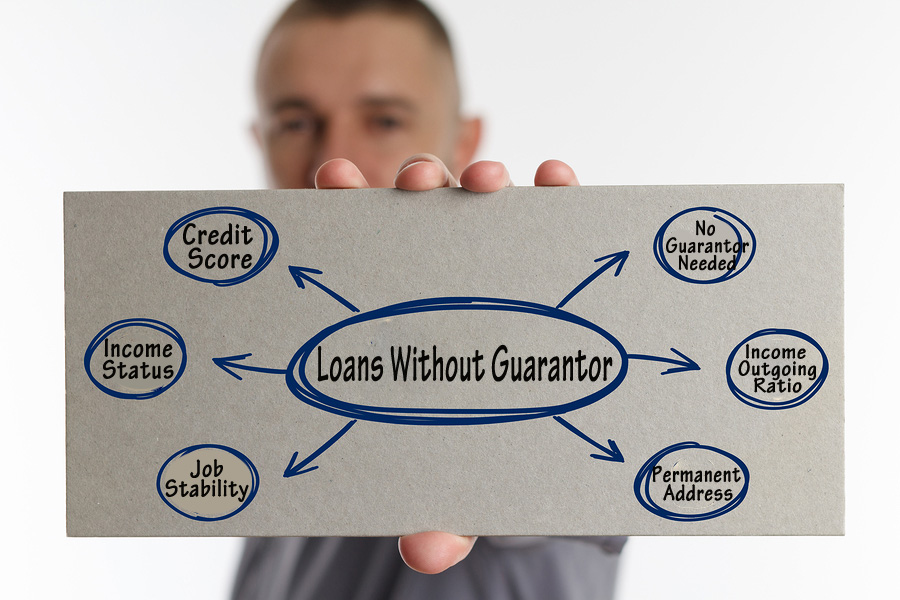

APR which is Annual Percentage Rate is the total annual cost of a loan. It is a decisive factor for both the lender and the borrower. Lending and borrowing funds is a mutual activity. You check everything about the lender and also loan product as everything affects you. As APR is a decisive factor, your circumstances in turn affect it and make the lender do the due changes and alterations in the deal. It is necessary to know exactly what personal circumstances can leave an impact on Annual Percentage Rate and make it go high or low.

Of Course, The Credit Score

The very first thing that the lenders in the loans without guarantor are curious about is the credit rating of the applicant. You too perhaps are familiar with the unavoidable presence of credit score performance in the lending world. Good credit score brings the lower APR’s and poor credit cause the rise in rates. The reason behind this is clear. Good credit means responsible financial behaviour and bad credit rating means flaws and weakness in financial capacity. There should be something for the lender to compensate the risk in case of bad credit, and nothing better can be than offering the loan on high total cost.

Current Income Status

Your current income is always a matter of interest for the loan companies. The more you earn, the better is considered your repayment capacity. Whatever you borrow, you need to pay it back and for that it is necessary to earn a certain income. This decides the eligibility for the loan amount. Good income means it is easy to qualify for required loan amount. The credit rating factor walks together. Suppose your credit rating is bad but income is good then the chances to get approval of desired loan amount improve. The rates are decided with mutual consent but not with much possibility of compromise on the side of the lender.

Job Stability

Every single factor counts and job stability is the one. It is always good to stay long in the same job as it leaves a good impression on the lender. Your long stay in one job proves the career stability and that in turn proves financial stability. What else can lending companies want? Frequent changes in the job can make the lender offer the loan on higher APR. For bad credit people, it becomes more important to remain in one job for long.

Duration of Stay at the Current Address

Whether you live in a rented property or live in your own house, if you are staying there from a long period of time, it shows stability. Having your own home is the best thing. Just like job stability, duration of the stay on the present address is also taken under consideration. Besides, it is favourable to find your current address in the electoral roll. It tells about who you are, where do you live and with whom you live.

Income Outgoing Ratio

You get a certain percentage of your income as a loan. But the income outgoing ratio affects that. Suppose the income is good but outgoings are more than half of your income then despite good income, you may qualify for a less amount. The concern is to increase the chances of timely instalments. With more expenses and less savings on income, how a lender can trust on your repayment capacity? Every single income and expense counts. It becomes more important in case of bad credit scorers and people on benefits who apply for loans for bad credit people with no guarantor on benefits.

Make sure all the above circumstances are working in your favour. Once you make them work in the right direction, they are sure to bring the best possible Annual Percentage Rate for you. Best of luck!