Whenever you apply for a loan, the first thing done by the lender is to check your eligibility criteria towards a loan applied. the lender would check your eligibility parameters before offering you the loan. Some important factors which affect your eligibility criteria are Your age, occupation, income, work experience, etc. are important eligibility criteria. Moreover, your credit score is also an important parameter based on which the loan is offered. If you have a good score your loan is approved taking no time and if your score is low, your loan application would be rejected.

Though credit score is important, many of you are unaware of the concept and the reason why it is important. So, here is a brief detail about credit score and its importance when availing loans –

What is a credit score?

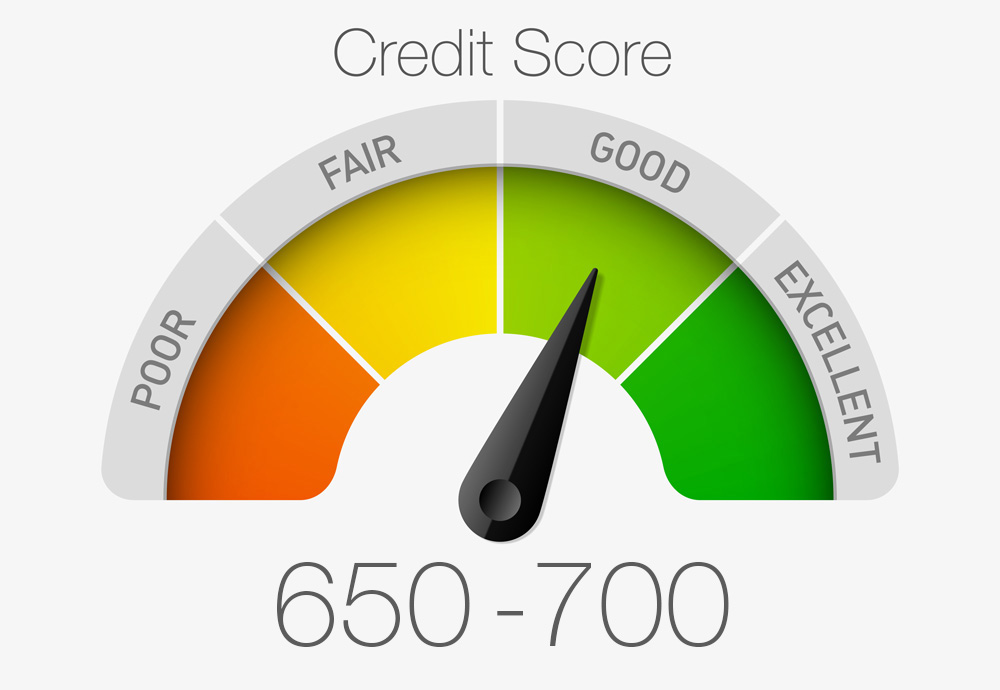

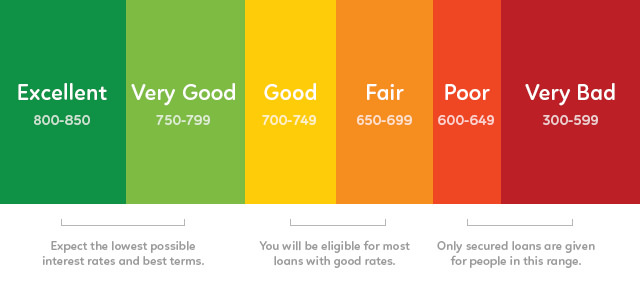

A credit score is a numerical score assigned to portray your creditworthiness. The score measures your credit history and depicts how good a borrower you are. The score ranges from 300 to 900. Scores over 700 are considered good and loans are easily available at such scores. Lower scores, however, are a cause of concern because availing of loans becomes difficult.

Why a credit score is important?

A credit score is important because of two main reasons which are as follows –

The score determines your loan approval

As stated earlier, lenders have a minimum credit score criterion. If your score is below the minimum level the loan would not be approved. Lenders usually require a credit score of 650 and above. In some cases, however, the minimum credit score can be 700 and above. So, if you have a score lower than the minimum level, your loan application would be rejected and you wouldn’t be able to avail the funds that you require.

The score determines the interest rate

Many of you might not be aware of know this but your credit score also affects the interest rate of your loan. If your score is average or low, you might avail a loan in some instances but the interest charged on such loans would be high. On the other hand, if your credit score is high, lenders might allow you lower interest rates especially on personal loans wherein the risk of default is high. So, your credit score is inversely proportional to your loan interest rate. Higher the score lower would be the loan interest rate and vice-versa.

Since the score determines two of the main aspects of a loan, you should maintain a good credit score. Maintaining a good score is not a difficult task if you are aware of the know how. If you take the below mentioned steps, you would be able to easily build and improve your credit score –

- Pay your credit card bills and other loans EMIs on time without making any default

- Do not make too many loan applications within a short period of time

- Do not avail too many unsecured loans. Maintain a good mix of different types of secured and unsecured loans in your financial portfolio

- Check your score at regular intervals to monitor it and improve if required

- Do not maximize the utilization of your credit limit

So, the next time your lender enquires about your credit score, understand the meaning of the score and its importance. Also, maintain a high score for availing loans easily.